21 Aug IRS Expands Benefits That Can Be Provided Before HDHP Annual Minimum Deductible Is Met

IRS Expands Benefits That Can Be Provided Before HDHP Annual Minimum Deductible Is Met

A notice was recently released by the Internal Revenue Service (IRS) that expanded the list of preventative care benefits a high deductible health plan (HDHP) can provide without a deductible or with a deductible below the annual minimum deductible. Read this blog post from UBA to learn more about this compliance update.

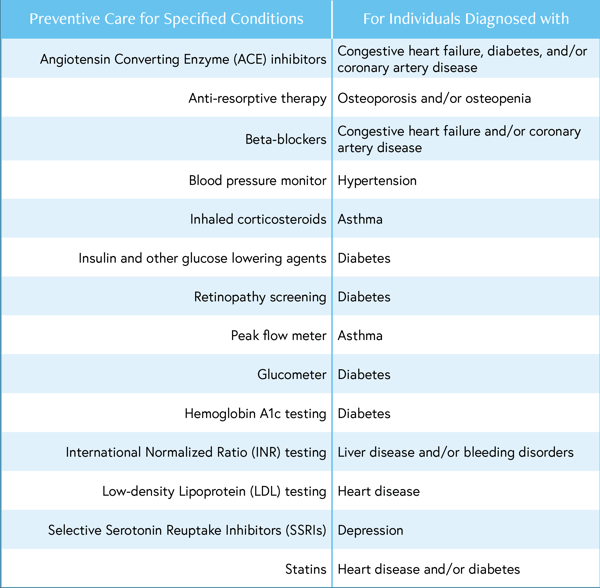

The Internal Revenue Service (IRS) released a notice, effective on July 17, 2019, that expanded the list of preventive care benefits that a high deductible health plan (HDHP) can provide without a deductible or with a deductible below the annual minimum deductible.

The services and items listed above are treated as preventive care:

- only when prescribed to treat a person diagnosed with the associated chronic condition listed in the table’s second column, and

- only when prescribed for the purpose of preventing the chronic condition’s exacerbation or a secondary condition’s development.

SOURCE: Hsu, K. (20 August 2019) “IRS Expands Benefits That Can Be Provided Before HDHP Annual Minimum Deductible Is Met” (Web Blog Post). Retrieved from https://blog.ubabenefits.com/irs-expands-benefits-that-can-be-provided-before-hdhp-annual-minimum-deductible-is-met