15 Nov PPOs Dominate Despite Savings with HMOs and CDHPs

Are you searching for a detailed look at health care costs across all available health care plans? Fortunately, we have a survey that will help you gain this outlook. In this article, our partner, UBA Benefits, provides insight on the rise of health care costs and which health care plans are the most popular (costly or not).

Don’t miss your chance to get your customized results.

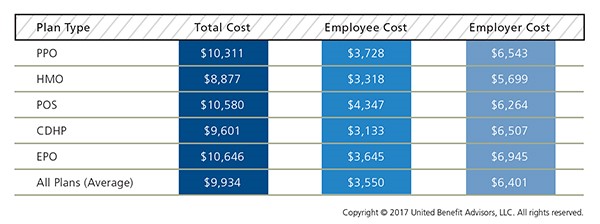

The findings of our 2017 Health Plan Survey show a continuation of steady trends and some surprises. It’s no surprise, however, that costs continue to rise. The average annual health plan cost per employee for all plan types is $9,934, an increase from 2016, when the average cost was $9,727. There are significant cost differences when you look at the data by plan type.

Cost Detail by Plan Type

PPOs continue to cost more than the average plan, but despite this, PPOs still dominate the market in terms of plan distribution and employee enrollment. PPOs have seen an increase in total premiums for single coverage of 4.5% and for family coverage of 2.2% in 2017 alone.

HMOs have the lowest total annual cost at $8,877, as compared to the total cost of a PPO of $10,311. Conversely, CDHP plan costs have risen 2.2% from last year. However, CDHP prevalence and enrollment continues to grow in most regions, indicating interest among both employers and employees.

Across all plan types, employees’ share of total costs rose 5% while employers’ share stayed nearly the same. Employers are also further mitigating their costs by reducing prescription drug coverage, and raising out-of-network deductibles and out-of-pocket maximums.

More than half (54.8%) of all employers offer one health plan to employees, while 28.2% offer two plan options, and 17.1% offer three or more options. The percentage of employers now offering three or more plans decreased slightly in 2017, but still maintains an overall increase in the last five years as employers are working to offer expanded choices to employees either through private exchange solutions or by simply adding high, medium-, and low-cost options; a trend UBA Partners believe will continue. Not only do employees get more options, but employers also can introduce lower-cost plans that may attract enrollment, lower their costs, and meet ACA affordability requirements.

You can read the original article here.

Source:

Olson B. (7 November 2017). “PPOs Dominate Despite Savings with HMOs and CDHPs” [Web blog post]. Retrieved from address https://blog.ubabenefits.com/ppos-dominate-despite-savings-with-hmos-and-cdhps

SaveSave

SaveSave