08 Sep IRS Proposes New Section 6055 Reporting Requirements for Self-Insured Employers

Great article from our partner, United Benefit Advisors (UBA) by Vicki Randall

Employers with self-insured health plans are facing new Section 6055 regulations regarding the reporting of minimum essential coverage. The proposed regulation requires self-insured employers to report this information to the IRS on either Form 1095-B or in Part III of Form 1095-C, if the coverage is provided by an applicable large employer.

Section 6055 reporting identifies those individuals who are enrolled in minimum essential coverage. In order to accomplish this, the reporting forms require the inclusion of each individual’s Taxpayer Identification Number (TIN). For an individual, this is his or her Social Security number. While employers generally have the SSNs of their employees, they are less likely to have this information for an employee’s spouse or dependents. The proposed regulations include new guidance relating to the solicitation of TINs and the solicitation process employers should follow in order to avoid any penalties for filing without the proper TINs.

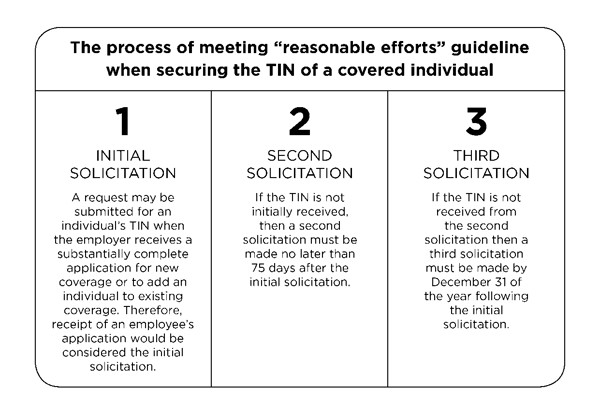

As long as “reasonable efforts” are made to secure the TINs of covered individuals, an employer is permitted to report a date of birth when no TIN has been provided. The proposed regulations lay out the following three-point process that should be used in order to meet the “reasonable efforts” guideline.

If individuals are already enrolled in coverage, July 29, 2016, is to be used as the initial solicitation date as long as a TIN was solicited as part of the application for coverage or at any other point before July 29, 2016. The second solicitation is then required within 75 days after July 29, 2016, which would be October 12, 2016.

If individuals are already enrolled in coverage, July 29, 2016, is to be used as the initial solicitation date as long as a TIN was solicited as part of the application for coverage or at any other point before July 29, 2016. The second solicitation is then required within 75 days after July 29, 2016, which would be October 12, 2016.

Dan Bond, Principal at Compliancedashboard said, “Interestingly enough, these proposed regulations do not change the solicitation process for incorrect TINs, and there remains some confusion over what the IRS deems as a trigger for soliciting TINs in the situation that they are incorrect. They included a footnote in these proposed regulations that we presume is referencing the AIR [Affordable Care Act Information Returns] filing system that says just because an error message is received, that error message isn’t a notice for a penalty. Nor does the filer need to start the solicitation process in response to the error message. This statement leaves some question as to what triggers a solicitation need. We are watching to see what the IRS does with this.”

Although this process is part of a proposed rule, the IRS has stated that self-insured employers may rely on the process pending the release of a final rule.

For applicable large employers and self-funded employers of all sizes who have now completed the first round of required IRS reporting under the Patient Protection and Affordable Care Act (ACA), request UBA’s ACA Advisor, “IRS Reporting, Now What?” for information on play or pay penalties, when the penalty is triggered, how the penalty will be assessed and documentation employers must have.

Topics: ACA, PPACA, self funded health plans, IRS Form 1095, Section 6055 Reporting

See the original article Here.

Source:

Randall, V. (2016 September 6). IRS propses new section 6055 reporting requirements for self-insured employers. [Web log post]. Retrieved from address https://blog.ubabenefits.com/irs-proposes-new-section-6055-reporting-requirements-for-self-insured-employers