29 Mar Case Study: Using Data to Identify Healthcare Savings for a Mid-size Manufacturer

Original post ubabenefits.com

Historically, companies have struggled with the best way to package and deliver benefits to attract talent and retain staff. Today, companies understand that they need to leverage a variety of solutions to provide meaningful healthcare coverage, promote wellbeing and mitigate cost. UBA Partners offer innovative product and service solutions to identify medical spend waste and improve efficient spend, allowing employers to reinvest in the correct resources that will improve employee health. For one mid-sized manufacturer, UBA Partner LHD Benefit Advisors used Vital Incite risk scoring tools to coordinate efforts between the employer HR and C-suite, the advisor and the population health consultant.

Key information unique to this employer:

- Japanese owned and multiple nationalities employed with little knowledge of the American health care system other than in the HR team

- Manufacturing company with predominately male employees

- Onsite clinic opened April 2014 with initial services including primary care, physical therapy, massage therapy, lab, nurse health coaching

- Increase in medical plan participation due to growing workforce and rich medical plan offered at a low cost to employees.

Value of what was delivered:

- Improved risk migration of high/very high risk members (total population and same cohort)

- Improved efficiency of medical plan utilization and improved unit cost

- Improved care coordination (decreased ER visits, decrease in multiple medications, increase in number of members with a primary care physician)

- Targeted outreach from onsite clinic to improve overall health of members

Problem 1: Increase in medical plan spend

Prior to the clinic opening, the medical plan saw utilization of ER visits and imaging services along with associated costs above benchmark. The number of covered lives (employees and spouses) was also increasing as well as the average employer paid amount per member due to high cost utilization of an unmanaged workforce. Current medical plans were two low deductible, PPO plans with little consumerism and offered at low cost to employees.

Problem 2: Low onsite clinic utilization

The first six months the clinic was open showed low utilization for several services resulting in the employer reducing services effective January 1, 2015, through March 31, 2015, to help reduce costs. The suspended services included patient advocacy, evening clinic hours, reduced health coaching hours and physical therapy. In order to fully recognize the benefit of an onsite clinic, employees needed easier access to the clinic during working hours, a better understanding of services provided (i.e. labs, medications and nurse coaching) and targeted outreach to key members.

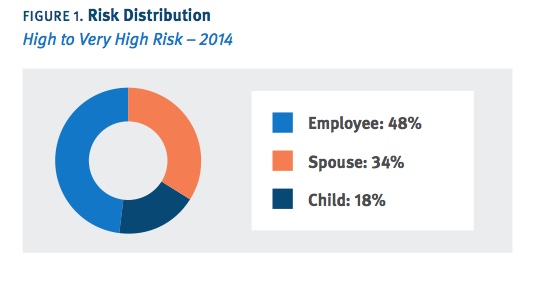

Problem 3: Increase in risk migration of member population

Data revealed employees carried the majority of the high/very high risk, and risk migration from 2013 to 2014 showed a neutral to slight increase (Figure 1). Further analysis showed a higher than average percentage of untreated chronic conditions, including diabetes, high cholesterol and high blood pressure. Cost information from a disease perspective showed the potential impact specific disease programs within the clinic could have on employee health and medical cost.

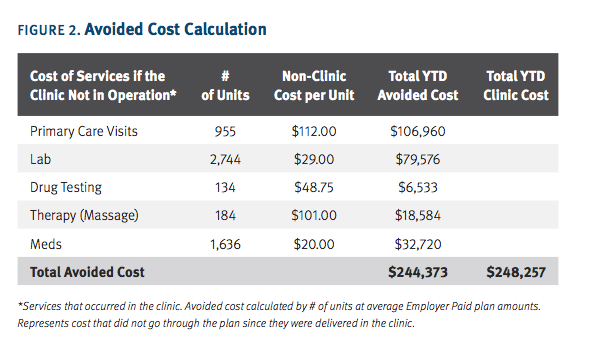

Analysis of Avoided Costs

The data reported from the population health team was instrumental in developing a strategy to have an impact on the member population and a successful onsite clinic. Once there was an understanding of the prospective risk and impact of chronic disease management by the employer C-suite, the HR team gained support for the initiatives developed by the population health and HR teams. A key illustration (Figure 2) to this point was showing a cost avoidance calculation for key services provided by the onsite clinic.